Reimagining financial services through adaptive, personalized, and context-aware design

Overview

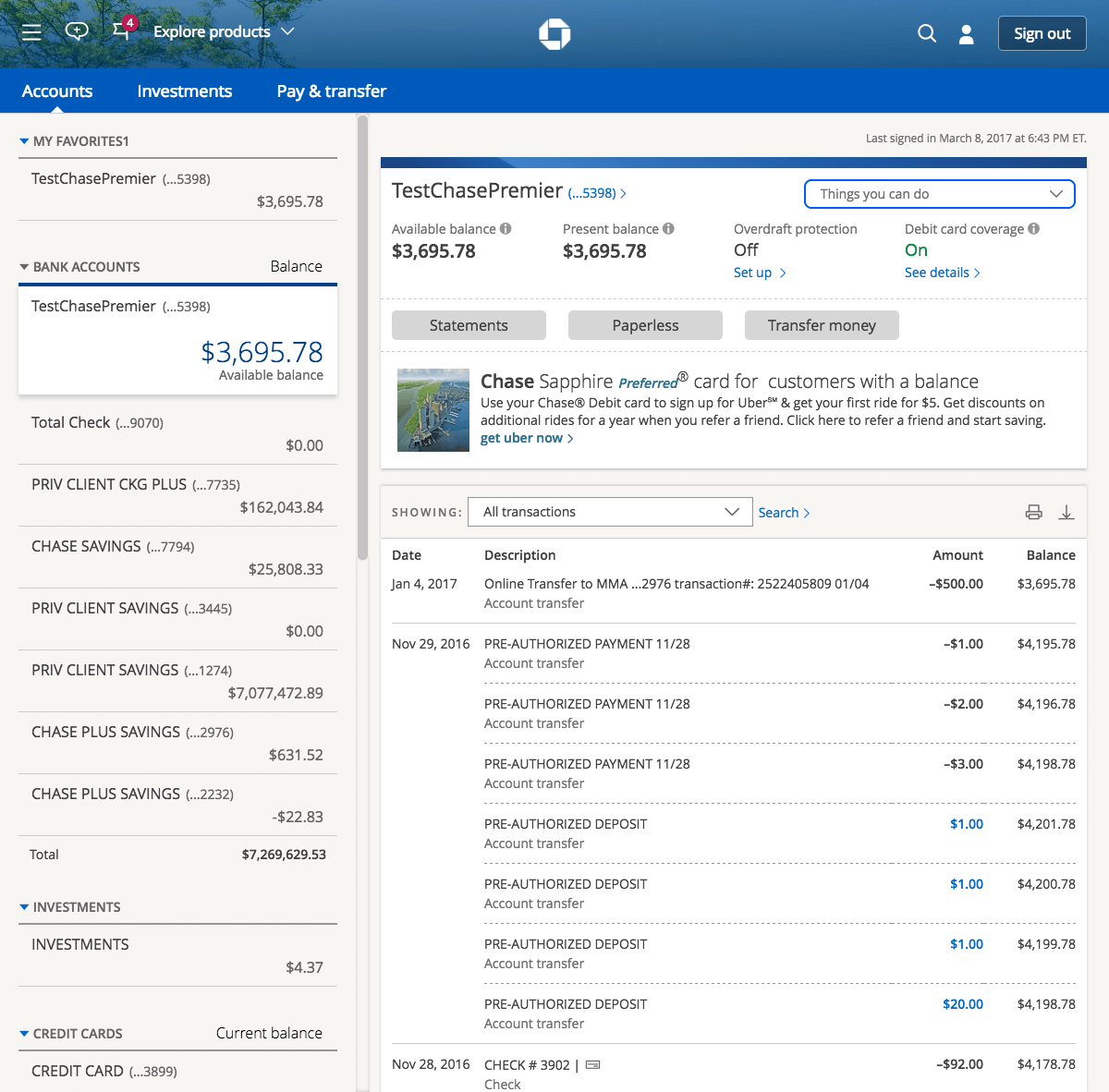

Over 3.5 years onsite at JPMorgan Chase, I led a 40-person UX team through a multi-platform transformation of Chase’s personal banking and investing experiences. Our vision was to make digital banking simpler, more human, and deeply personal, empowering users in their financial lives through intelligent design.

We delivered scalable personalization, granular customization, and real-time contextualization, all rooted in Chase’s brand philosophy of Everyday Living. This work redefined the user experience for tens of millions of customers across web, iOS, and Android.

My Role

- Led cross-functional teams across UX, research, content strategy, and visual design

- Spearheaded product design across personal banking, investing, and native app platforms

- Operationalized personalization, customization, and contextualization at scale

- Helped define the evolving Chase design system used companywide

- Partnered closely with stakeholders across product, legal, and engineering

The Challenge

Customers expected a modern banking experience, but Chase’s legacy platforms delivered uniform, static, and impersonal interactions.

We aimed to go far beyond a redesign. We set out to deliver experiences that recognized each customer’s preferences, behaviors, and life context, helping Chase feel less like a utility, and more like a trusted companion.

Strategic Approach

We grounded the redesign in three interdependent pillars of intelligent UX:

- Personalization — Relevant, Anticipatory, and HumanWe designed systems that responded to who you are and how you behave, surfacing tailored features, content, and actions:

- Usage-based functionality: Prioritized frequently used and contextually relevant tasks

- Smart content: Predicted needs based on behaviors and adapted search, ads, and offers

- Behavioral personalization: Interfaces shifted based on experience level, preferences, and archetypes (e.g., “simple” vs. “capable” modes)

- Demographic-aware language: Tone and interface adapted to life stage, needs, and goals

- Customization — Designed for Choice and ControlWe empowered users to define how Chase fit into their life, through modular UX and flexible interaction:

- Dashboard configuration: Custom views, task prioritization, and visual expression

- Feature toggling: Users could opt into complexity or streamline for simplicity

- Preference definition: Users could tell us their financial goals, accessibility needs, relationships, communication styles, and automation levels

- Favorites and shortcuts: Personalized action centers to support daily usage patterns

- Contextualization — Adapting to the MomentWe built experiences that adjusted based on time, device, location, and user activity:

- Geo-aware content: ATM locators, personalized greetings, travel alerts, and proximity-based services

- Device-specific UX: Tailored layouts, gestures, and session behaviors per platform

- Temporal intelligence: Surfaced tax reminders, investment insights, or nudges based on seasonality or time of day

- Cross-sell & support: Recommended products and help based on real-time browsing and task history

Process Highlights

Research & Discovery

- Conducted task analysis, diary studies, and behavioral segmentation

- Mapped existing UX friction across Chase’s legacy systems

- Benchmarked competitors’ limitations in intelligent UX

- Used analytics to identify abandonment and engagement patterns

Design & Prototyping

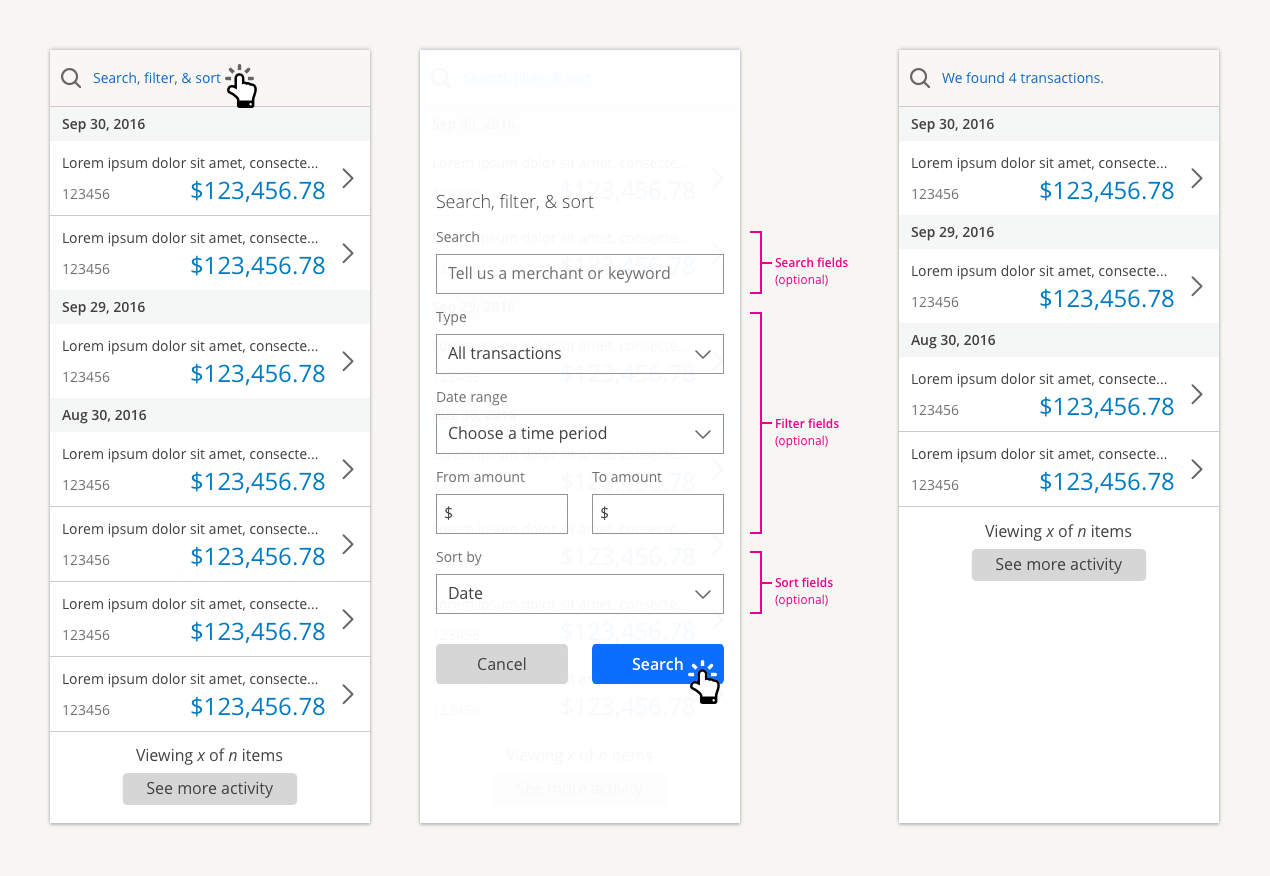

- Created dynamic wireframes and personalized flows

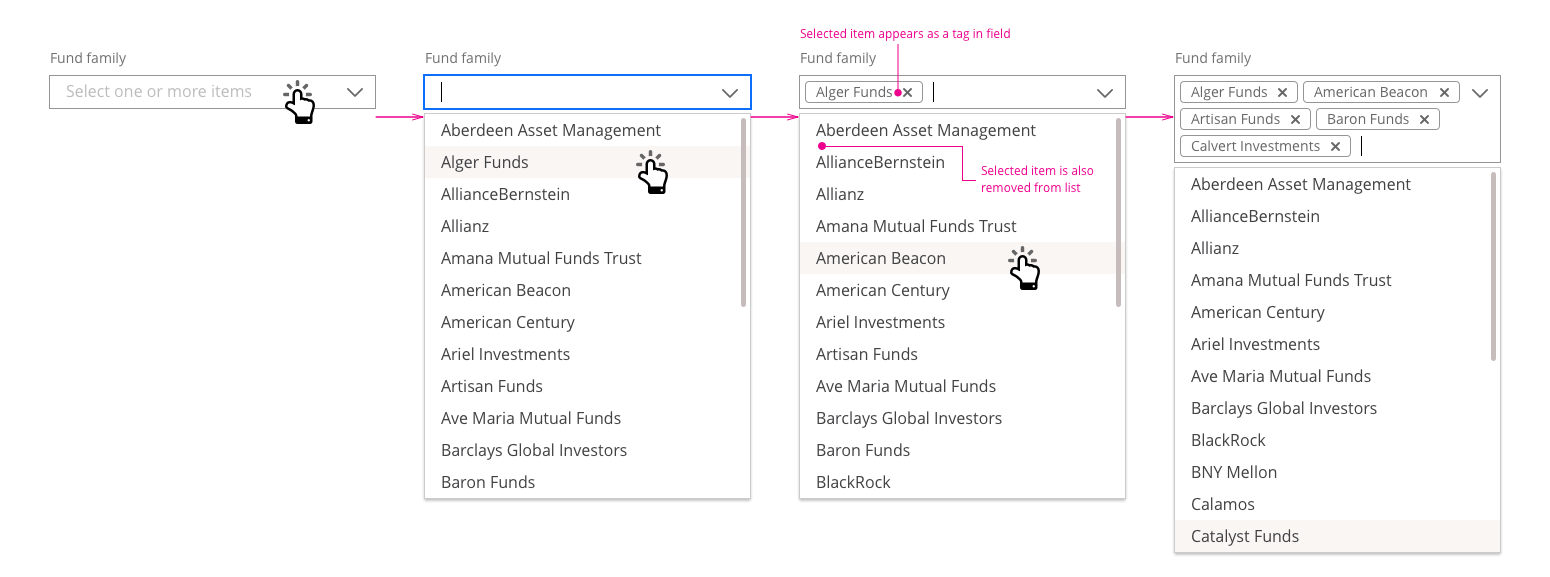

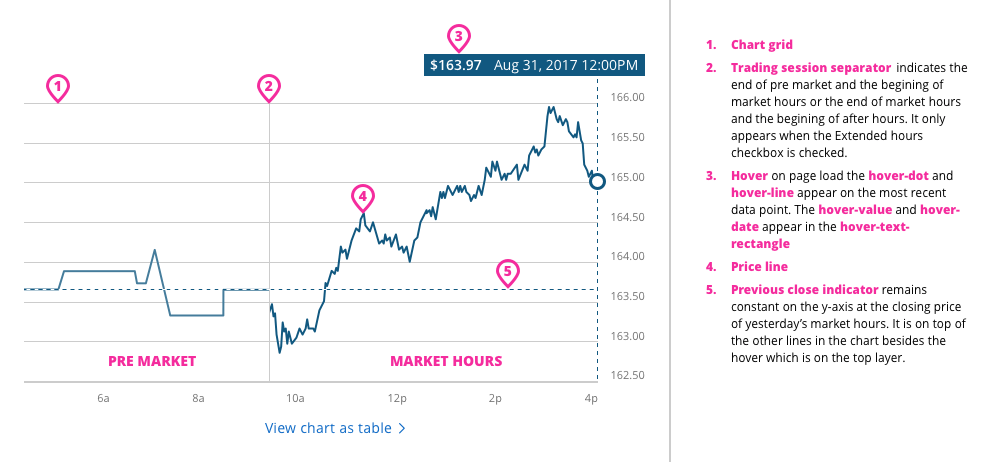

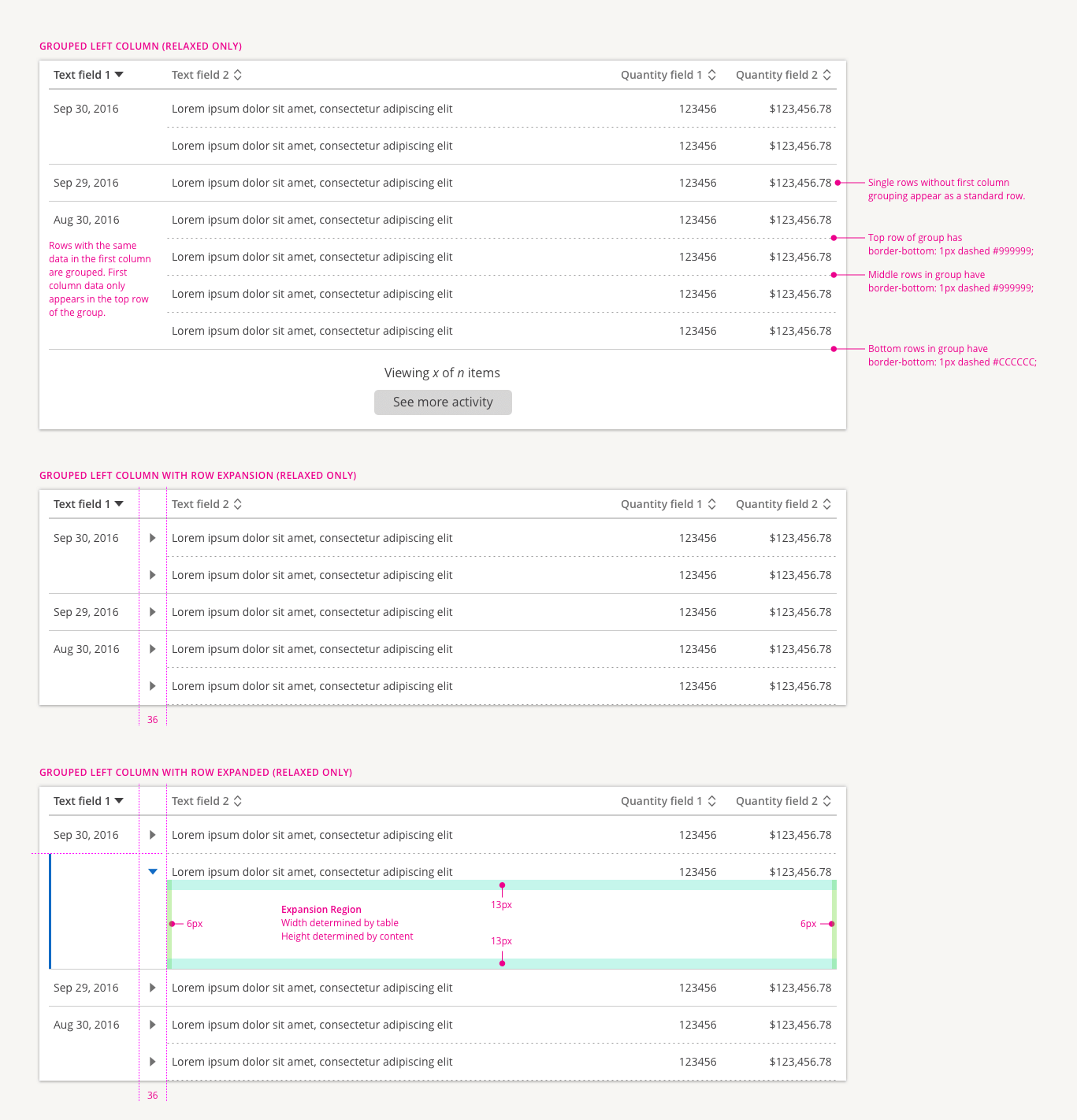

- Developed modular, scalable UI components within the design system

- Modeled contextual interface changes triggered by behavioral and environmental signals

- Aligned designs with accessibility, compliance, and brand voice standards

Validation & Iteration

- Conducted usability testing across web, iOS, and Android platforms

- A/B tested personalized dashboards, search behaviors, and offers

- Integrated analytics feedback loops to inform content and feature prioritization

- Co-created with compliance and engineering to ensure feasibility and consistency

Modular, Scalable Design System

- Created reusable patterns and component libraries

- Integrated accessibility standards from the ground up

- Ensured brand fidelity using the Octagon, Chase Blue, and emotionally resonant visuals

- Standardized responsive logic for cross-platform coherence

Business Outcomes

- Improved digital NPS scores, especially in mobile and self-service journeys

- Reduced call volume due to better discoverability and smart support features

- Increased cross-sell conversion rates via relevant, contextual recommendations

- Boosted engagement through custom task flows and content prioritization

- Enabled faster product delivery through reusable, systematized components

What Set This Apart

This wasn’t personalization in name only. We built a digital experience that evolved with each user: learning their needs, anticipating their next actions, and meeting them where they were.

Whether someone was setting up their first checking account, preparing for tax season, or managing investments before retirement, Chase’s platform adapted to them—not the other way around.